multistate tax commission form

It is the executive agency charged with administering the Multistate Tax Compact. However the selling dealer must also obtain a resale authorization number from the.

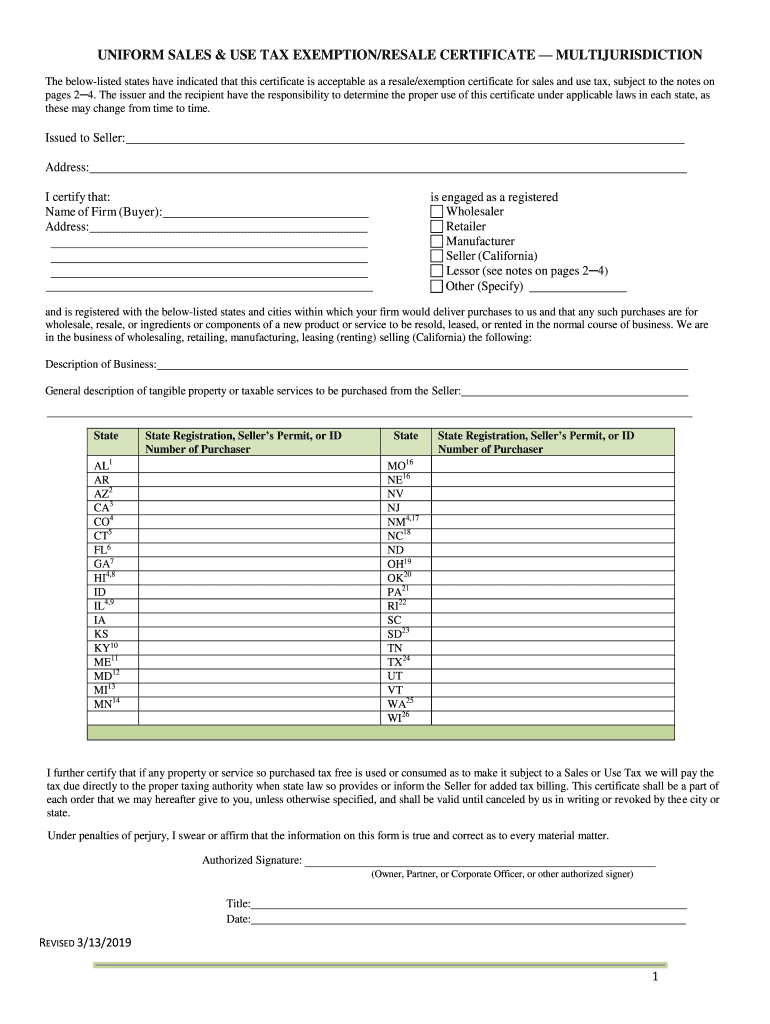

Uniform Sales And Use Tax Exemption Certificates Accuratetax Com

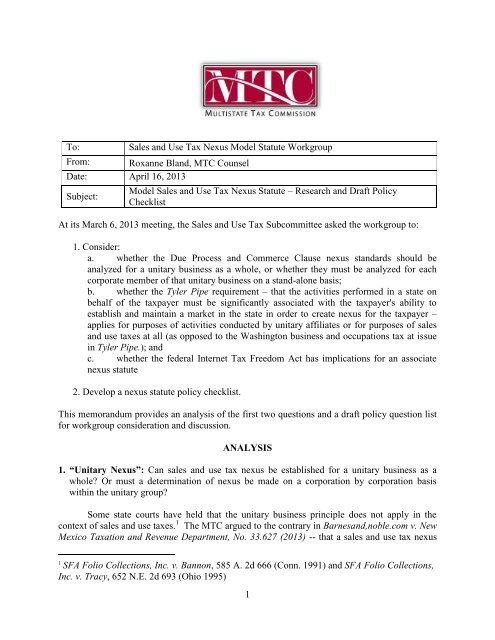

The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co.

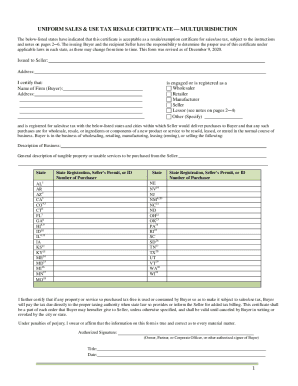

. The UNIFORM SALES USE TAX RESALE CERTIFICATE MULTIJURISDICTION Multistate Tax Commission form is 2 pages long and contains. Executive Director Gregory S. Click the Get form key to open the document and start editing.

Looking for the abbreviation of multistate tax commission. As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. Submit the requested fields they are yellowish.

Direct Filing 33 Washington St 7th fl Newark NJ. The Multistate Tax Commission is an intergovernmental tax cooperative agency that was born from the multistate tax compact law. Commission members acting together attempt to promote uniformity in state tax laws.

To be accepted as a blanket resale certificate the purchaser must complete the form in its entirety and add a general. MULTACK - MULTEWS - MULTEWS-A - MULTI - MULTICS - MULU - MUM. Director of Administration William Six.

Many companies use it even for documenting exemptions in only one state mostly because it is so widely available. All appeals must include a copy of this form and must be sent to BOTH the Civil Service Commission PO. The New York Department of Taxation and Finance has finally provided guidance regarding telecommuting tax liability for nonresident employees working outside of New York because of the COVID-19 pandemic.

A blanket resale certificate is applicable to multiple transactions between a buyer and a seller. Box 312 Trenton NJ. You have the right to appeal within 20 days from receipt of this form.

An agency can be labeled inactive if it has been abolished had a title change was merged into a different. The MTC MJ is the standard form to which most people refer when discussing the MultiJurisdiction form also sometimes called the MTC MJ Multi-J or just Multi. 444 North Capitol Street NW Suite 425.

Mon 15 Nov 2021 at 337 PM. Maybe you were looking for one of these abbreviations. Allows the Multistate Tax Commissions Uniform Sales and Use Tax Resale Certificate Multijurisdiction for tax-exempt purchases for resale.

08625-0312 AND the Office of Administrative Law. Employees telecommuting because of COVID-19 will generally still be required to pay New York taxes on income they earn. By way of.

As of 2011 47 states are members of the Commission in some capacity. Couldnt find the full form or full meaning of multistate tax commission. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance.

The Multistate Tax Commission is a United States intergovernmental state tax agency created by the Multistate Tax Compact in 1967. This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara.

Save Time Editing Signing Filling PDF Documents Online. The Multistate Tax Commission MTC issued the multijurisdiction resale certificate MTC certificate in July 2000 to provide a standard document for businesses to utilize that will be uniformly accepted by sellers. The Office of Multistate Tax Compact Commission for Texas is overseen by the Comptroller of Public Accounts.

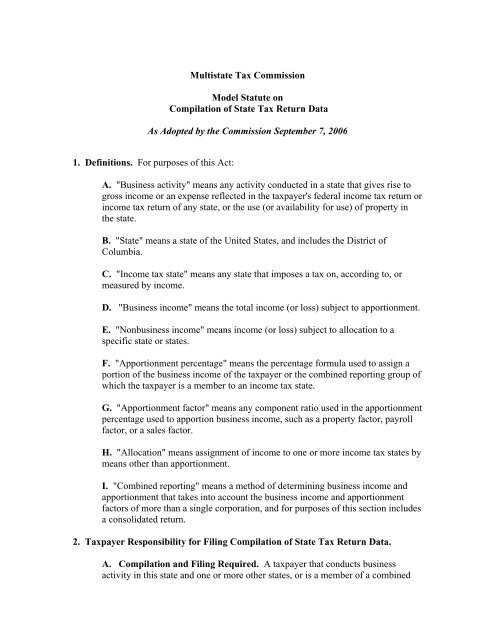

General Counsel Nancy Prosser. 86-272 has provided taxpayers with immunity from state income taxes when their connections within a. This allows multistate tax payers to properly apportion their tax liabilities in a manner that does not undertake any undue.

Complete Fillable Multistate Exemption Certificate Fillable in just a few moments by simply following the guidelines listed below. For more than 60 years PL. 86-272 income tax immunity.

Commission members acting together attempt to. Join Now for Instant Benefits. The Multistate Tax Commission not more than once in five years may adjust the 100000 figure in order to reflect such changes as may occur in the real value of the dollar and such adjusted figure upon adoption by the Commission shall replace the 100000 figure specifically provided herein.

Including assertion of jurisdiction to tax. Its purpose is to create uniformity amongst state tax laws and foster fair equalization of tax base revenues. Pick the document template you want from our library of legal forms.

For example if the project was 30 complete at the end of the tax year 30 of the bid price should be included in the gross receipts. The Multistate Tax Commission has created a Uniform Sales and Use Tax Exemption Certificate to meet this need and the MTC multistate tax form has been accepted by 38 states for use as a blanket resale certificate. Ad Professional Document Creator and Editor.

Deputy Executive Director Scott Pattison. This agency is currently inactive. The Multistate Tax Commission is an interstate instrumentality located in the United States.

On average this form takes 14 minutes to complete. APPEAL PROCEDURE TO THE EMPLOYEE. During the 71st Legislative Session in 1989 the offices separate Sunset date was removed.

This tutorial video goes over how-to configure accepted states on the Multistate Tax Commission MTC form in EXEMPTAX. This tutorial goes over how-to configure accepted states on the Multistate Tax Commission MTC form in EXEMPTAX. Form 402 Instructions Individual Apportionment for Multistate Businesses completed at the end of the tax year.

Gross receipts from a construction project are attributable to Idaho if the construction is. On August 4 2021 the Multistate Tax Commission MTC approved an update to its Statement of Information Concerning Practices of the Multistate Tax Commission and Supporting States under Public Law 86-272 PL. And in the case of the Rental Purchase Agreement Occupation and Use Tax should use Form ST-261.

How-to Use Multistate Tax Commission MTC Forms.

Mtc Form Fill Out And Sign Printable Pdf Template Signnow

Materials Multistate Tax Commission

.jpg.aspx)

Multistate Tax Commission News

Mtc Uniformity Committee Discusses Past Work Upcoming Projects Wolters Kluwer

Uniform Sales Use Tax Certificate Multi Jurisdiction Form Fillable Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Form St 3 New Jersey Resale Certificate Pdf4pro

To Obtain A Copy Of The Request For Information Rfi Multistate Tax

Draft Model Uniform Statute On Multistate Tax Commission

Fillable Online Tax Utah Cover Letter For Tax Commission Form Fax Email Print Pdffiller

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Multistate Tax Commission News

.jpg.aspx)

Multistate Tax Commission News

How To Fill Out The Sst And Mtc Exemption Certificate Forms Youtube

Multistate Tax Commission Home

Mtc Uniform Sales Use Tax Exemption Resale Certificate 2019 2022 Fill And Sign Printable Template Online Us Legal Forms

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Exemption Administrationtraining Related To Accepting Certificates Ppt Download